Business Insurance in and around Saint Louis

Calling all small business owners of Saint Louis!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

When you're a business owner, there's so much to keep track of. You're not alone. State Farm agent Kelly Wicks is a business owner, too. Let Kelly Wicks help you make sure that your business is properly covered. You won't regret it!

Calling all small business owners of Saint Louis!

Helping insure small businesses since 1935

Protect Your Future With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a tailoring service or a physician or you own a dry cleaner or a toy store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Kelly Wicks. Kelly Wicks is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Contact State Farm agent Kelly Wicks's team today to explore the options that may be right for you.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

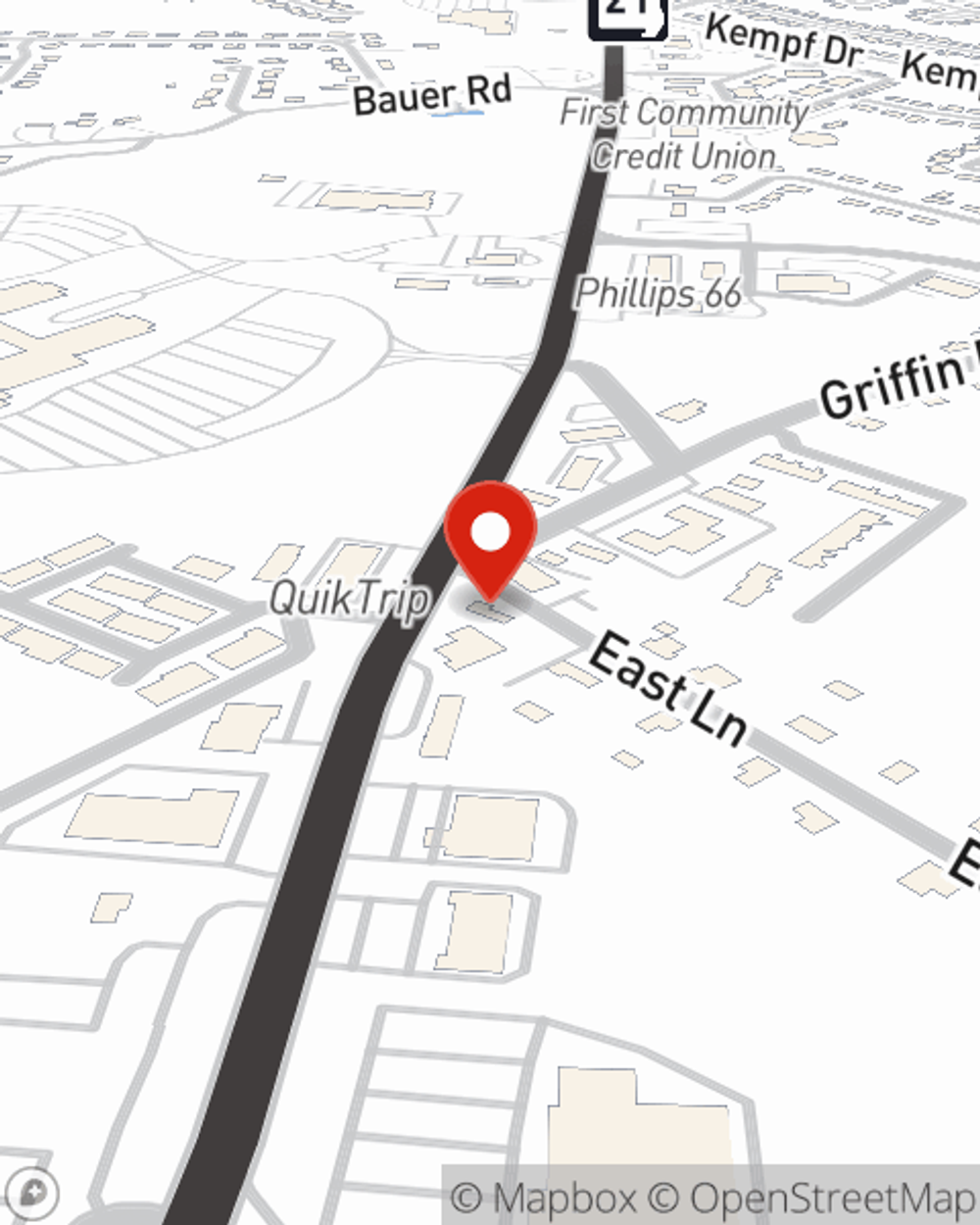

Kelly Wicks

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.